There are a few early warning indicators to watch out for when a business collapses that can assist you in handling the situation before it spirals out of control. The first sign is frequently lack of money, which may manifest as a delay in paying expenses.

It is critical to recognise these warning indicators as soon as possible so you can respond appropriately and avert insolvency. You might be able to, for instance, renegotiate your debt repayment terms or find a source of alternative funding to support your company in the long run.

So, based on Stephen Taylor, a well-known and successful businessman, what are the tell-tale indicators of business failure?

- Your business has too much debt

You should consider how much of your activities are supported by you versus your creditors. A business may be under stress if this ratio is high and is coupled with a low interest cover ratio.

- You are not too sure what your business does

If you are unsure of what your company does or how it makes money.

- Your auditors are doubting your account statements

Qualified accounts are audited accounts when the auditor has concerns or differs from the management of the company this is a very strong indicator of operational or financial hardship.

- Profit warnings

An earnings warning informs investors that the company’s earnings will fall short of projections. This is typically made public two or more weeks before the company’s earnings are formally disclosed to the general public. Important: If there is a profit warning, pay immediate attention.

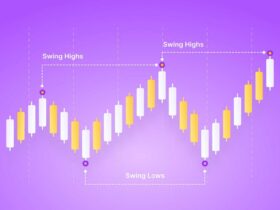

- Profit versus cashflow

Watch out for businesses that post significant profits but with little to no operating cash flow.

- Deteriorating payment practices

Follow up immediately if payments from your company are falling or starting to come in “lumps.”

- Late filing of accounts

This may be a hint of internal business issues or difficulties getting the auditor to approve the accounts.

- You are not sure about your business’ financial position

It is simpler for a business to enter insolvency if you don’t know exactly how much it owes or is owed by its own debtors. If you carry on doing business when insolvent, you then incur the danger of engaging in improper trading.

- Constantly ‘firefighting’ issues

It is a clear indication that the company is failing when you feel like you have more difficulties than you can manage on a daily basis rather than focusing on expanding it.

Perhaps your debtors are pressuring you for money or important employees are quitting. Whatever the issue maybe, making progress seems impossible.

- Loss of a key customer

Cash flow can suffer greatly if you only have one or two major clients, and one of them decides to depart. Gaining new clients takes time, but falling into bankruptcy can happen very rapidly, and the loss of a crucial client might be the beginning.

You must seek an expert support when you notice any of the signs that are mentioned in this post.