These regulations and laws vary by country and jurisdiction, shaping the landscape of tax planning and compliance. Tax reduction is a legitimate financial strategy that aims to minimize tax liabilities within the boundaries of existing regulations and laws Here’s an overview of the key aspects governing tax reduction:

Tax Codes and Legislation

- Tax reduction strategies are heavily influenced by the tax codes and legislation of a specific jurisdiction.

- Tax laws define taxable income, applicable tax rates, and allowable deductions and credits.

Tax Planning

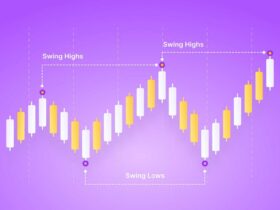

- Tax reduction often involves meticulous tax planning, which organizes financial affairs to legally minimize tax liabilities.

- Strategies may include income splitting, investment structuring, and timing transactions to optimize tax outcomes.

Tax Deductions and Credits

- Identification and utilization of eligible tax deductions and credits are central to tax reduction.

- Deductions reduce taxable income, while credits directly reduce tax owed.

Tax-Advantaged Accounts

- Many jurisdictions offer tax-advantaged accounts like retirement (e.g., 401(k), IRA) and education savings accounts (e.g., 529 plans).

- Contributions and/or earnings grow tax-deferred or tax-free in these accounts.

International Taxation

- International tax laws, including double taxation treaties, govern taxation of income earned in multiple countries.

- Multinational corporations employ transfer pricing and legal entity structures to optimize global tax liability.

Tax Havens and Offshore Structures

- Some entities utilize tax havens and offshore structures for legal tax reduction.

- These structures face international scrutiny, prompting evolving regulations to combat tax evasion and enhance transparency.

Anti-Avoidance Rules

- Jurisdictions deploy anti-avoidance rules to prevent abusive tax avoidance practices.

- These rules target aggressive tax planning strategies exploiting legal loopholes.

Reporting and Compliance

- Accurate income reporting and compliance with tax laws are obligatory.

- Non-compliance can result in penalties, fines, and legal repercussions.

Tax Professionals and Advisers

- Tax reduction strategies often necessitate guidance from experts, such as accountants, tax attorneys, and financial advisers.

- Professionals ensure tax strategies align with laws and regulations.

Tax Audits and Enforcement

- Tax authorities conduct audits to verify tax return accuracy and law adherence.

- Tax evasion can lead to severe consequences, including fines, imprisonment, and asset seizures.

Conclusion

In conclusion, tax reduction strategies should adhere to the rule of law and be executed with a commitment to compliance. Collaboration with qualified professionals and staying updated on tax law changes is essential to ensure both legal tax reduction and avoidance of legal issues. As tax laws are subject to frequent updates and amendments, a proactive approach to tax planning and reduction is advisable.