In today’s fast-paced world, making smart financial choices is more important than ever. From budgeting and saving to investing and borrowing, the decisions we make with our money can have a significant impact on our long-term financial well-being. In this article, we’ll explore some key strategies for managing your money effectively and making the most of your financial resources.

Choosing the Right Credit Card

One of the most important financial decisions you’ll make is choosing the right credit card. With so many options available, it can be overwhelming to navigate the world of credit cards. However, one option that stands out is the No Annual Fee Credit Card.

Benefits of a No Annual Fee Credit Card

A No Annual Fee Credit Card offers several advantages, including the ability to build credit without incurring additional costs. These cards often come with competitive interest rates and may even offer rewards or cash back on purchases. By choosing a card that fits your spending habits and financial goals, you can maximize the benefits while minimizing the costs.

Budgeting Tips

When creating a budget, be sure to include all of your essential expenses, such as housing, utilities, and groceries. Additionally, allocate funds towards savings and debt repayment to ensure that you’re making progress toward your financial goals. By reviewing your budget regularly and making adjustments as needed, you can stay on track and avoid overspending.

Choosing the Right Bank Account

Another important aspect of managing your money is choosing the right bank account. While many people opt for a personal checking account, there are other options available that may better suit your needs.

Exploring Alternative Bank Accounts

In addition to personal checking accounts, you may want to consider opening a savings account or a money market account. These accounts typically offer higher interest rates than checking accounts and can help you grow your savings over time. Additionally, some banks offer specialized accounts for specific financial goals, such as retirement or college savings.

Investing for the Future

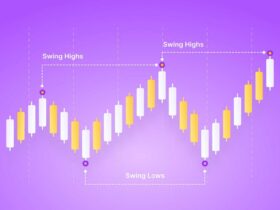

Investing is another key component of managing your money effectively. By putting your money to work in the financial markets, you can potentially grow your wealth over time and achieve your long-term financial goals.

Types of Investments

There are many different types of investments to choose from, including stocks, bonds, mutual funds, and real estate. Each type of investment carries its own risks and potential rewards, so it’s important to do your research and choose investments that align with your risk tolerance and financial goals.

Seeking Professional Guidance

When it comes to investing, it’s always a good idea to seek professional guidance. Financial advisors can help you develop a personalized investment strategy that takes into account your unique circumstances and goals. They can also provide valuable insights and advice on managing your investments over time.

Conclusion

Managing your money effectively is an ongoing process that requires discipline, planning, and a willingness to learn. By making smart financial choices, such as choosing the right credit card and bank account, creating a budget, and investing for the future, you can take control of your finances and work towards a more secure financial future. Remember, there is no one-size-fits-all approach to money management. What works for one person may not work for another. By staying informed, seeking professional guidance when needed, and making adjustments as your circumstances change, you can navigate the complexities of personal finance and achieve your financial goals.