The forex market offers various trading strategies, but two of the most popular approaches are day trading and swing trading. Each has its distinct characteristics, advantages, and challenges, making them suitable for different types of traders. For those looking to trade the EUR/USD pair, understanding which strategy aligns with their trading style, time commitment, and risk tolerance is key. In this article, we’ll explore the ins and outs of both day trading and swing trading, providing you with the knowledge needed to determine which approach works best for you.

Understanding Day Trading

Day trading is a strategy that involves buying and selling currency pairs within the same trading day. It’s a fast-paced method where traders capitalize on short-term price movements, closing all positions before the market closes. In day trading, positions are held for minutes to hours, but not overnight. This strategy is particularly popular among traders who enjoy real-time analysis and rapid decision-making.

When trading the EUR/USD pair, day traders focus on minute-to-minute price fluctuations, often using technical analysis to predict short-term trends. The key advantage of day trading EUR/USD is the ability to exploit small, quick movements in price. This can be particularly lucrative during high liquidity periods, such as when both the European and U.S. markets are active. Since positions are closed before the end of the day, day traders avoid the risks associated with overnight market gaps.

Technical analysis plays a crucial role in day trading. Indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands are commonly used to spot trends and reversals. For those trading EUR/USD, staying updated with economic news releases is equally important. Announcements like the U.S. Non-Farm Payrolls or the European Central Bank’s monetary policy decisions can trigger significant price movements, offering profitable opportunities for day traders. If you’re looking to delve deeper into the mechanics of trading EUR/USD, understanding how to navigate the Euro Dollar Forex market is essential.

Understanding Swing Trading

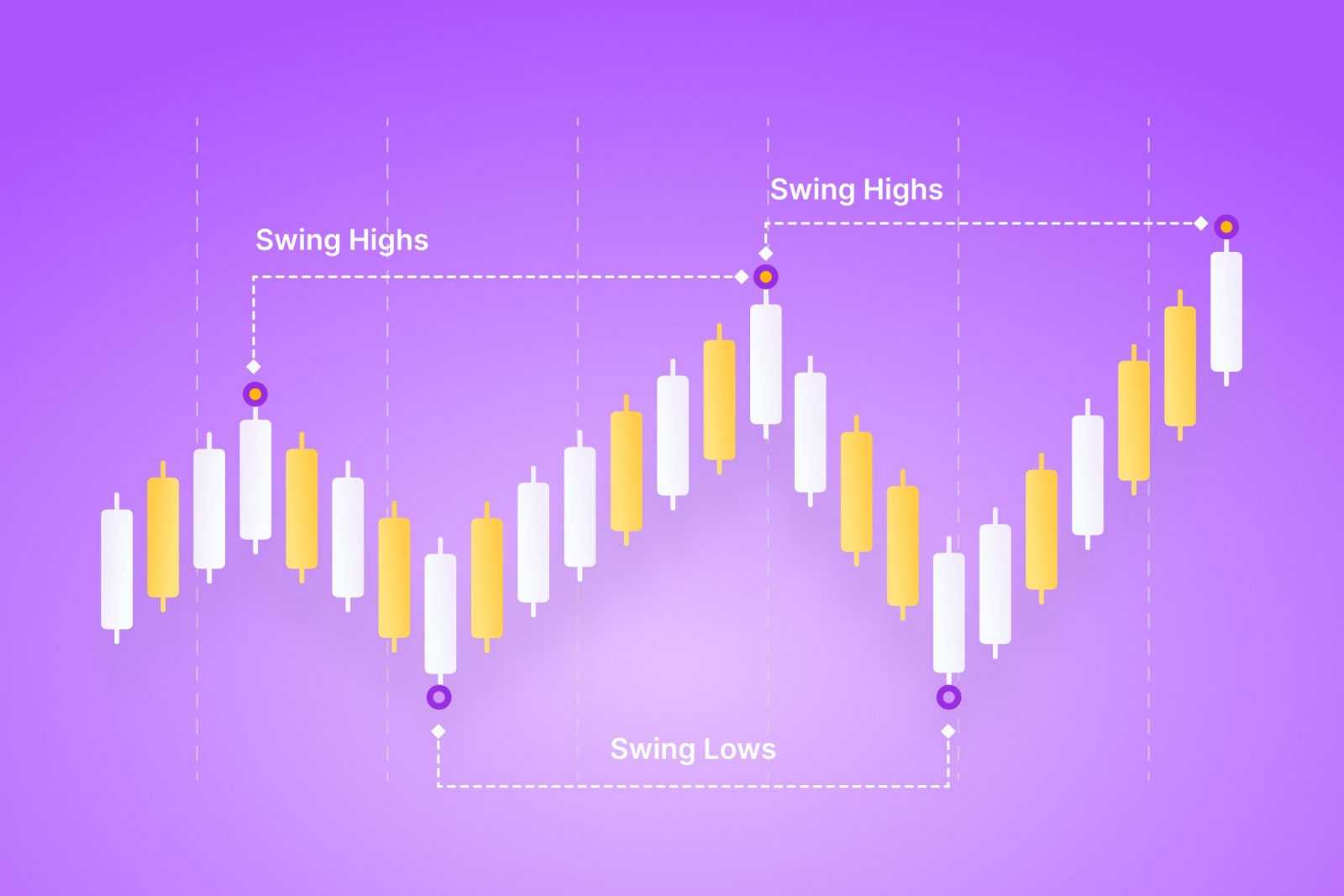

Swing trading takes a longer-term approach, holding positions for several days to capture medium-term trends. Unlike day trading, which focuses on intraday price movements, swing traders aim to profit from the price swings that occur over several days or even weeks. This strategy requires a broader perspective and a bit more patience, as swing traders are not looking for immediate returns but rather for substantial movements over some time.

For EUR/USD traders, swing trading provides an opportunity to profit from larger price changes than those typically seen in day trading. The key advantage here is that swing traders can take advantage of trends, holding positions for as long as the market moves in their favour. Since fewer trades are made, transaction costs tend to be lower compared to day trading, which involves multiple trades per day.

However, swing trading also carries its own set of challenges. One of the main drawbacks is the exposure to overnight market risks. Since positions are held for longer periods, swing traders are vulnerable to unexpected market shifts that can occur when they are not actively monitoring their trades. Additionally, swing trading requires discipline and patience, as it may take several days to see a position reach its full potential. Unlike day trading, where the focus is on short-term charts, swing traders often rely on longer-term technical indicators and chart patterns to identify potential trade setups.

Comparing Day Trading and Swing Trading for EUR/USD

When comparing day trading and swing trading, one of the most important factors to consider is time commitment. Day trading is a highly time-consuming strategy that requires constant attention to the market, especially during active trading hours. For traders with full-time jobs or other commitments, this can be a significant disadvantage. On the other hand, swing trading offers more flexibility, as positions are held for several days, allowing traders to check their trades less frequently.

Risk management is another key difference between the two strategies. Day traders benefit from the fact that they close their positions before the market closes, eliminating the risk of overnight price gaps. However, the fast-paced nature of day trading can also lead to impulsive decisions that increase risk. Swing traders, on the other hand, are exposed to the possibility of overnight market movements, which can be both a risk and an opportunity. While swing traders may encounter larger price fluctuations, they can also benefit from capturing bigger trends over a longer period.

Profit potential is another consideration. Day traders typically target smaller, quicker profits by taking advantage of short-term price movements. This approach can be highly effective when the market is volatile and liquidity is high, but the profit per trade is usually modest. Swing traders aim for larger price swings, allowing them to capture more significant profits, but this comes with the risk of holding positions longer and potentially facing larger drawdowns if the market moves against them.

Conclusion

Both day trading and swing trading offer unique advantages and challenges, particularly when it comes to trading the EUR/USD pair. Day trading can be highly profitable during volatile, high-liquidity periods, but it demands constant attention and quick decision-making. Swing trading, on the other hand, provides an opportunity to capture larger price movements over several days, offering flexibility and lower transaction costs. The key to success lies in choosing the strategy that matches your lifestyle, risk profile, and trading objectives.