Evaluating mutual fund performance is crucial for making informed investment decisions. Among the various metrics, XIRR (Extended Internal Rate of Return) is a key indicator for calculating returns, especially for investments through a systematic investment plan (SIP). This metric provides deeper insights by factoring in the timing and amounts of each contribution or withdrawal. For investors exploring options like the Aditya Birla Mutual Fund, understanding XIRR can provide valuable insights into the true potential of their investments.

What is XIRR in Mutual Funds?

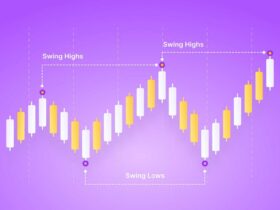

XIRR is a metric that calculates the annualised return of investments where multiple cash flows, such as SIP contributions, withdrawals, or redemptions, occur at irregular intervals. Unlike other metrics such as absolute returns or CAGR (Compound Annual Growth Rate), XIRR accounts for the precise timing of each transaction, providing a much more accurate and detailed picture of performance for investments with non-uniform cash flows.

For instance, you invest fixed amounts periodically over time in an SIP. As the value of your investment grows, XIRR helps accurately determine how effectively these periodic contributions have generated returns.

Why is XIRR Important?

XIRR is particularly useful for comparing mutual funds and determining how well they align with your financial goals. It addresses challenges posed by irregular investments, making it an indispensable tool for:

- Assessing SIP Returns: Regular contributions can make tracking returns complex, but XIRR simplifies this by accounting for each cash flow’s timing and value.

- Evaluating Portfolio Performance: When analysing a diversified portfolio of mutual funds, XIRR ensures a clear understanding of annualised returns across investments.

- Comparing Funds: Metrics like XIRR allow you to compare funds like equity-oriented mutual funds and index funds to identify options that align with your risk appetite and investment horizon.

How to Calculate XIRR

The formula for XIRR involves solving for the discount rate that equates the net present value (NPV) of cash flows to zero. Thankfully, tools like Excel or financial calculators make this process straightforward:

- List all cash inflows and outflows, ensuring correct dates are associated with each transaction.

- Use the XIRR function in Excel or similar tools to compute the result.

- Interpret the value as the annualised annualised return of your investment.

Factors to Consider When Using XIRR

While XIRR provides a reliable measure of performance, keep in mind:

- Market Volatility: XIRR reflects historical performance but doesn’t account for future market changes.

- Comparison with Benchmarks: Use benchmarks like Nifty or Sensex to gauge if a fund’s XIRR meets industry standards.

- Fund Type: Equity funds, hybrid funds, and index funds each have different risk-return profiles, impacting XIRR values.

Understanding mutual funds, XIRR equips investors to make informed decisions tailored to their unique financial goals and investment timelines. Whether investing in SIPs or lump sums, XIRR offers a nuanced and comprehensive view of returns, making it easier to compare funds, evaluate performance, and optimise your portfolio effectively. To explore funds like the Aditya Birla Mutual Fund, delve deeper into how powerful metrics like XIRR can guide and enhance your overall investment journey toward achieving financial success.